| o |

| Preliminary Proxy Statement | ||||||||

| o |

| Confidential, for Use of the Commission Only (as permitted by Rule | ||||||||

| þ |

| Definitive Proxy Statement | ||||||||

| o |

| Definitive Additional Materials | ||||||||

| o |

| Soliciting Material Pursuant to §240.14a-12 | ||||||||

BELDEN INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| BELDEN INC. | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| þ |

| No fee required. | ||||||||

| o |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||||||

1)Title of each class of securities to which transaction applies: | ||||||||||

2)Aggregate number of securities to which transaction applies: | ||||||||||

3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||||||||||

4)Proposed maximum aggregate value of transaction: | ||||||||||

5)Total fee paid: | ||||||||||

| o | ||||||||||

| Fee paid previously with preliminary materials. | |||||||||

| o |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||||||

1)Amount Previously Paid: | ||||||||||

2)Form, Schedule or Registration Statement No.: | ||||||||||

3)Filing Party: | ||||||||||

4)Date Filed: | ||||||||||

| |||||

9, 2024

| AGENDA ITEM | BOARD RECOMMENDATION | |||||||

1.Election of the directors nominated by the Company’s Board of Directors | FOR ALL NOMINEES | |||||||

2.Ratification of the appointment of Ernst & Young as the Company’s Independent Registered Public Accounting Firm for | FOR | |||||||

3.Advisory vote on executive compensation for | FOR | |||||||

|

| |||||||

| Sincerely,

Ashish Chand President and Chief Executive Officer | ||||||||

314‑854‑8000

AGENDA 1.To elect the directors nominated by the Company’s Board of Directors, each for a term of one year 2.To ratify the appointment of Ernst & Young as the Company’s independent registered public accounting firm for 3.To hold an advisory vote on executive compensation for 4.

WHO CAN VOTE You are entitled to vote if you were a stockholder at the close of business on March FINANCIAL STATEMENTS The Company’s By Authorization of the Board of Directors,

Brian E. Anderson Senior Vice President – Legal, General Counsel and Corporate Secretary Saint Louis, Missouri April | DATE: | Thursday, May 23, 2024 | |||||||||||||

| TIME: |

|

| |||||||||||||

| PLACE: |

|

| |||||||||||||

| Four Seasons Hotel Saint Louis

Laclede Room, 999 North 2nd Street Saint Louis, Missouri 63102 | ||||||||||||||

VOTING Please vote as soon as possible to record your vote promptly, even if you plan to attend the annual meeting. You have three options for submitting your vote before the annual meeting: | |||||||||||||||

|

| Phone (if you request a full delivery of the proxy materials) | |||||||||||||

| |||||||||||||||

| Internet | |||||||||||||||

|

|

| |||||||||||||

| Mail (if you request a full delivery of the proxy materials) | ||||||||||||||

2023

23, 2024

|

|

|

|

|

1 |

| 45 | ||

|

|

|

|

|

|

|

|

|

|

1 |

|

| ||

1 |

| 46 | ||

|

|

|

|

|

2 |

| 47 | ||

|

|

|

|

|

|

|

|

|

|

4 |

| 47 | ||

9 |

| 47 | ||

10 |

|

| ||

10 |

| 47 | ||

10 |

| Beneficial Ownership Table of Directors, Nominees and Executive |

| |

10 |

| 48 | ||

11 |

| Beneficial Ownership Table of Stockholders Owning More Than Five |

| |

11 |

| 49 | ||

Related Party Transactions and Compensation Committee Interlocks | 11 |

| 50 | |

11 |

| 50 | ||

11 |

| 54 | ||

12 |

|

| ||

13 |

| I-1 | ||

14 |

|

|

| |

|

|

|

|

|

15 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

15 |

|

|

| |

Fees to Independent Registered Public Accountants for 2022 and 2021 | 15 |

|

|

|

15 |

|

|

| |

16 |

|

|

| |

|

|

|

|

|

17 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

17 |

|

|

| |

17 |

|

|

| |

18 |

|

|

| |

18 |

|

|

| |

18 |

|

|

| |

19 |

|

|

| |

19 |

|

|

| |

20 |

|

|

| |

20 |

|

|

| |

21 |

|

|

| |

21 |

|

|

| |

21 |

|

|

| |

22 |

|

|

| |

26 |

|

|

| |

28 |

|

|

| |

30 |

|

|

| |

30 |

|

|

| |

30 |

|

|

| |

35 |

|

|

| |

35 |

|

|

| |

35 |

|

|

| |

36 |

|

|

| |

38 |

|

|

| |

39 |

|

|

| |

40 |

|

|

| |

41 |

|

|

| |

42 |

|

|

| |

42 |

|

|

| |

42 |

|

|

|

B.Elements | |||||

I-1 | |||||

| 2024 Proxy Statement | Page i | ||||||

GENERAL INFORMATION

| GENERAL INFORMATION | ||

| For questions Regarding: | Contact: | |||||||

|

| |||||||

Annual meeting or Executive Compensation Questions | Belden Investor Relations, | |||||||

Stock ownership |

| |||||||

| Equiniti Trust Company http:// 800-468-9716 | |||||||

| ||||||||

Stock ownership (Beneficial Owners) | Contact your broker, bank or other nominee | |||||||

| Voting | ||||||||

| Belden Corporate Secretary, | |||||||

| 2024 Proxy Statement | Page 1 | ||||||

Name of Director |

|

| Audit |

|

|

| Compensation |

|

|

| Cybersecurity |

|

|

| Finance |

|

|

| Nominating and Corporate Governance |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David J. Aldrich(1) |

|

|

|

|

|

|

| Member |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Lance C. Balk |

|

|

|

|

|

|

| Chair |

|

|

|

|

|

|

|

| Member |

|

|

|

|

|

| ||

Steven W. Berglund |

|

| Member |

|

|

|

|

|

|

|

| Member |

|

|

|

|

|

|

|

|

|

|

| ||

Diane D. Brink |

|

|

|

|

|

|

|

|

|

|

|

| Chair |

|

|

|

|

|

|

|

| Chair |

| ||

Judy L. Brown |

|

| Member |

|

|

|

|

|

|

|

|

|

|

|

|

| Chair |

|

|

|

|

|

| ||

Nancy Calderon |

|

| Chair |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Ashish Chand(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jonathan C. Klein |

|

|

|

|

|

|

| Member |

|

|

| Member |

|

|

|

|

|

|

|

| Member |

| |||

YY Lee(3) |

|

| Member |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Gregory McCray |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Member |

|

|

| Member |

| ||

Meetings held in 2022 |

|

|

| 12 |

|

|

|

| 5 |

|

|

|

| 4 |

|

|

|

| 4 |

|

|

|

| 5 |

|

|

|

|

|

| Name of Director | Audit | Compensation | Cybersecurity | Finance | Nominating and Corporate Governance | ||||||||||||

David J. Aldrich(1) | Member | ||||||||||||||||

| Lance C. Balk | Chair | Member | |||||||||||||||

| Steven W. Berglund | Member | Member | |||||||||||||||

| Diane D. Brink | Chair | Chair | |||||||||||||||

| Judy L. Brown | Member | Chair | |||||||||||||||

| Nancy Calderon | Chair | ||||||||||||||||

| Ashish Chand | |||||||||||||||||

| Jonathan C. Klein | Member | Member | Member | ||||||||||||||

| YY Lee | Member | ||||||||||||||||

| Gregory McCray | Member | Member | |||||||||||||||

| Meetings held in 2023 | 11 | 5 | 5 | 4 | 6 | ||||||||||||

|

|

| Page 2 | 2024 Proxy Statement |  | ||||||

| BOARD MEMBER DEMOGRAPHICS – DIRECTORS SEEKING REAPPOINTMENT | ||

| Belden Inc. Board Diversity Matrix as of April 9, 2024 (Directors Seeking Reappointment) | ||||||||

| Total Number of Directors | 9 | |||||||

| Female | Male | |||||||

| Part I: Gender Identity | ||||||||

| Directors | 4 | 5 | ||||||

| Part II: Demographic Background | ||||||||

| African American or Black | 0 | 1 | ||||||

| Asian | 1 | 0 | ||||||

| White | 3 | 4 | ||||||

| LGBTQ | 1 | |||||||

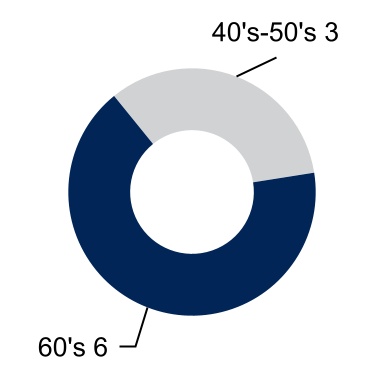

AVERAGE AGE 61 Years | ||

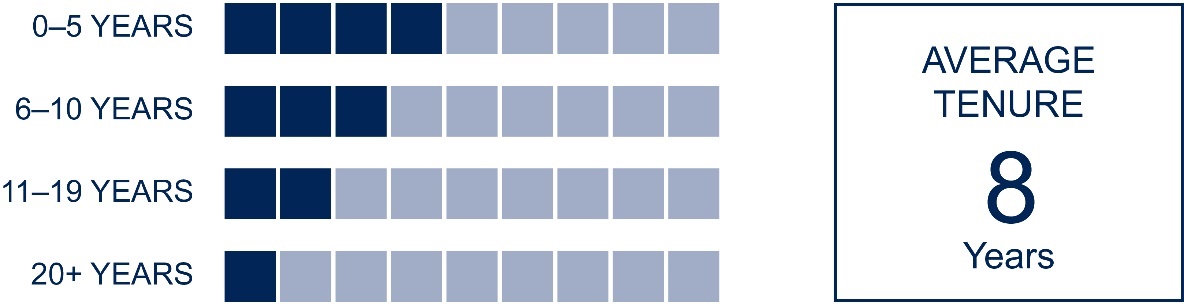

| BOARD MEMBER TENURE | ||

| 0-5 YEARS | AVERAGE TENURE 9 Years | |||||||||||||||||||||||||||||||||||||

| 6-10 YEARS | ||||||||||||||||||||||||||||||||||||||

| 11-19 YEARS | ||||||||||||||||||||||||||||||||||||||

| 20+ YEARS | ||||||||||||||||||||||||||||||||||||||

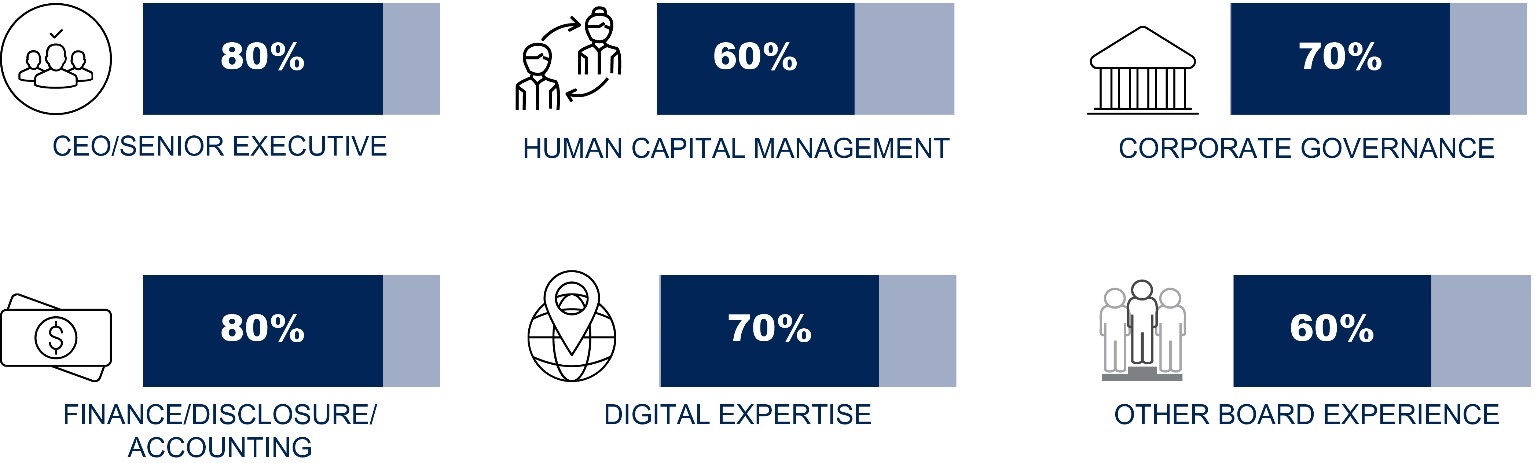

| BOARD MEMBER SKILLS | ||

| 2024 Proxy Statement | Page 3 | ||||||

BOARD MEMBER DEMOGRAPHICS

Belden Inc. Board Diversity Matrix as of April 11, 2023 |

|

| ||

Total Number of Directors | 10 |

| ||

| Female | Male |

| |

Part I: Gender Identity |

| |||

Directors | 4 | 6 |

| |

Part II: Demographic Background |

| |||

African American or Black | 0 | 1 |

| |

Asian | 1 | 1 |

| |

White | 3 | 4 |

| |

LGBTQ | 1 |

| ||

BOARD MEMBER TENURE

BOARD MEMBER SKILLS

|

|

BIOGRAPHIES OF DIRECTORS SEEKING REAPPOINTMENT

|

| |||||||

DAVID J. ALDRICH, | LANCE C. BALK, | |||||||

Director Since: 2007, Chairman Board Committees: Compensation The Board recruited Mr. Aldrich based on his experience in high technology signal transmission applications and for his experience as a Chief Executive Officer of a public company. From April 2000 to May 2014, he served as President, Chief Executive Officer, and Director of Skyworks Solutions, Inc. (“Skyworks”). In May 2014, Mr. Aldrich was named Chairman of the Board and Chief Executive Officer of Skyworks. From May 2016 to May 2018, Mr. Aldrich served as Executive Chairman of Skyworks. From May 2018 until his retirement in May 2021, Mr. Aldrich served as Chairman of the Skyworks board of directors. Skyworks is an innovator of high performance analog and mixed signal semiconductors enabling mobile connectivity. Mr. Aldrich also serves on the Board of Directors (as Chairman), Audit Committee and Compensation Committee of indie Semiconductor, Microsystems, and the Board of Directors, Compensation Committee, and Nominating Committee of Mobix Labs. Mr. Aldrich has been granted a temporary exception from the board limit contained in the Company's Governance Principles. He intents to reduce his memberships to three within the next year. Mr. Aldrich received a B.A. degree in political science from Providence College and an M.B.A. degree from the University of Rhode Island. | Director Since: 2000 Board Committees: Compensation (Chair), Finance The Board originally recruited Mr. Balk based on his expertise in advising multinational public and private companies on complex mergers and acquisitions and corporate finance transactions. He provides insight to the Board regarding business strategy, business acquisitions and capital structure. In September 2010, Mr. Balk was appointed as General Counsel of Six Flags Entertainment Corporation, a position he held until his retirement in February 2020. Previously, Mr. Balk served as Senior Vice President and General Counsel of Siemens Healthcare Diagnostics from November 2007 to January 2010. From May 2006 to November 2007, he served in those positions with Dade Behring, a leading supplier of products, systems and services for clinical diagnostics, which was acquired by Siemens Healthcare Diagnostics in November 2007. Previously, he had been a partner of Kirkland & Ellis LLP since 1989, specializing in securities law and mergers and acquisitions. Mr. Balk received a B.A. degree from Northwestern University and a J.D. degree and an M.B.A. degree from the University of Chicago. | |||||||

| Page 4 | 2024 Proxy Statement |  | ||||||

|  | |||||||

| ||||||||

| DIANE D. BRINK, | JUDY L. BROWN, 55 | ||||||

Director Since: 2017 Board Committees: Cybersecurity (Chair), Nominating and Corporate Governance (Chair) The Board recruited Ms. Brink based on her marketing and digital transformation expertise and experience as a senior marketing executive at a Fortune 100 technology company. Ms. Brink currently serves as a Senior Fellow and Adjunct Professor of Marketing at the Kellogg School of Management at Northwestern University. Prior to her retirement in 2015, Ms. Brink served in a variety of roles at IBM, most recently as Chief Marketing Officer, IBM Global Technology Services. In June 2021, Ms. Brink was appointed to the Board of Directors and Compensation Committee and as chair of the Nominating Inc.. Ms. Brink attended Stony Brook University, where she received a B.S. in computer science. She received her M.B.A. from Fordham University. Ms. Brink is a member of the Dean’s Council in the College of Engineering | ||||||||

| |||

|

| |

|

| |

Director Since: 2008 Board Committees: Audit, Finance (Chair) In recruiting Ms. Brown, the Board sought a member with broad international perspective to pursue its global strategic goals and for her experience as a Chief Financial Officer of a public company. As an employee of Ernst & Young for more than nine years in the U.S. and Germany, Ms. Brown provided audit and advisory services to U.S. and European multinational public and private companies. She served in various financial and accounting roles for six years in the U.S. and Italy with Whirlpool Corporation, a leading manufacturer and marketer of appliances. In 2004, she was appointed Vice President and Controller of Perrigo Company, a global healthcare supplier of over-the-counter pharmaceutical products. She was promoted to Executive Vice President and Chief Financial Officer of Perrigo in 2006 and oversaw Finance, Information Technology and Corporate Affairs until her departure from Perrigo Company in February 2017. In April 2017, Ms. Brown was appointed Senior Vice President Global Business Solutions & Finance of Amgen Corporation, a global leader in biotechnology. There, Ms. Brown oversaw the company's Global Business Solutions, Internal Audit, Tax and Treasury organizations. From October 2018 through December 2022, Ms. Brown was Amgen’s Senior Vice President, Corporate Affairs, leading Amgen's strategic communications, philanthropy advocacy relations and ESG (Environmental, Societal and Governance) management. Additionally she served as the site head for Amgen's corporate headquarters in Thousand Oaks, California. Ms. Brown received a B.S. degree in Accounting from the University of Illinois; an M.B.A. degree from the University of Chicago; and attended the Aresty Institute of Executive Education of the Wharton School of the University of Pennsylvania. Ms. Brown also is a Certified Public Accountant. |

| 2024 Proxy Statement | Page 5 | ||||||

|  | |||||||

| NANCY CALDERON, 65 | ASHISH CHAND, 49 | |||||||

Director Since: 2020 Board Committees: Audit (Chair) The Board recruited Ms. Calderon for her deep executive management and audit experience. Ms. Calderon retired from KPMG LLP in September 2019 after a distinguished 33-year career. Most recently, Ms. Calderon served as KPMG's Global Lead Partner for a Fortune 50 Technology company since July 2012, senior partner of KPMG's Board Leadership Center since its inception in 2015, and as a director of KPMG's Global Delivery Center in India and its related holding companies since September 2011. Previously, she was KPMG's Americas Chief Administrative Officer and U.S. National Partner in Charge, Operations, from July 2008 to June 2012. Ms. Calderon sat on a number of KPMG committees, including the Americas Region Management Committee, Enterprise Risk Management, Privacy, Pension Steering and Investment, Social Media, and Knowledge Management. Ms. Calderon is presently a director of Northern Technologies International Corp., where she chairs the Audit Committee and serves on the Nominating and Corporate Governance Committee, Ms. Calderon attended the University of California at Berkeley and received a B.S. degree in accounting, and Golden Gate University where she received an M.S. degree in Taxation. | ||||||||

|

| ||

|

| |

|

| |

Director Since: 2023 President and Chief Executive Officer Dr. Chand serves as President and Chief Executive Officer of Belden Inc. Prior to his appointment as President and Chief Executive Officer, Dr. Chand served as Executive Vice President – Industrial Automation Solutions from June of 2019 until February 2023, and Managing Director of Belden Asia Pacific from August 2017. Dr. Chand has held roles across several functions, including sales and marketing and operations in both Asia and North America. Dr. Chand has played a pivotal role in developing and executing Belden’s long-term growth agenda, solutions and product strategy, and go-to-market efforts. Dr. Chand holds a B.A. in Economics from |

| Page 6 | 2024 Proxy Statement |  | ||||||

|  | |||||||

| JONATHAN C. KLEIN, 65 | YY LEE, 56 | |||||||

Director Since: 2015 Board Committees: Compensation, Cybersecurity, Nominating and Corporate Governance The Board recruited Mr. Klein for his extensive experience within the broadcast industry, more specifically his experience with programming, production, and over-the-top distribution models. Mr. Klein is the co-founder and CEO of Hang Media, a sports streaming platform launched in 2021. From 2012 to 2022, Mr. Klein served as the CEO and Co-Founder of TAPP Media, an over-the-top subscription video platform which operates paid channels built around personalities. From 2018 to 2019, Mr. Klein served as the President of Vilynx Inc., an artificial intelligence company focused exclusively on media. From 2004 to 2010, he served as President of CNN, leading the U.S. network to its highest ratings and profitability. Previously he had been the Founder and CEO of the FeedRoom, a pioneering online video aggregation site, developing new online advertising concepts which have become industry standards today. From 1996 to 1998, he served as Executive Vice President of CBS News, overseeing prime time programming and strategic planning for in-house studio productions.

Formerly, Mr. Klein Mr. Klein attended Brown University where he received a B.A. degree in history. | ||||||||

| |||

|

| |

|

| |

Director Since: 2023 Board Committees: Audit The Board recruited Ms. Lee for her extensive experience within the software industry, including her experience in senior operational roles as a chief executive officer and chief operating offer. Ms. Lee most recently served as Chief Strategy Officer for Anaplan, a business planning software company specializing in subscription cloud-based business planning software, from 2018 until her retirement in 2021. From 2005 to 2017, Ms. Lee was employed by FirstRain, Inc., as Chief Operating Officer from 2005 to 2015, and as CEO from 2015 until FirstRain was acquired by Ignite Technologies Ms. Lee is presently a director of Synaptics Incorporated, where she sits on the Compensation Committee and Audit Committee, and Commvault Systems Inc., where she sits on the Compensation (as chair) and Governance and Nominating committees. Ms. Lee attended Harvard University, graduating with an A.B. degree in Mathematics in 1990. |

| 2024 Proxy Statement | Page 7 | ||||||

| ||||||||

| GREGORY J. MCCRAY, 61 | ||||||||

Director Since: 2022 Board Committees: Finance, Nominating and Corporate Governance The Board recruited Mr. McCray for his extensive experience within the communications technology industry, including his experience as a current CEO. Since 2018, Mr. McCray has served as the CEO FDH Infrastructure Services LLC, an engineering firm that monitors, inspects, designs and performs engineering and analysis services for cellular and broadcast towers and other infrastructure assets. From March 2017 to August 2017, Mr. McCray served as CEO of Alphabet’s Access/Google Fiber business unit. From 2013 to 2016, Mr. McCray served as CEO of Aero Communications, a provider of installation, services and support to the communications industry. From 2003 to 2012, Mr. McCray served as CEO of Antenova Limited, a developer of high dielectric antenna components and RF modules for use in smartphones, tablets and other wireless devices. He previously held managerial and engineering roles at Lucent Technologies, AT&T, Bell Laboratories, and IBM. Mr. McCray is presently a director of ADTRAN, where he sits on the Audit and Compensation Committees, and DigitalBridge, where he sits on the Compensation and Nominating Mr. McCray attended Iowa State University of Science and Technology where he received a B.S. degree in Computer Engineering, and Purdue University where he received an M.S. degree in Systems Engineering. In March 2022, he was inducted into the Iowa State University Engineering Hall of Fame. | ||||||||

| Page 8 | 2024 Proxy Statement |  | ||||||

|

|

topics.

2022

Social:

Building on our commitment to our employees, in 2022 we introduced a universal parental leave policy that covers all our full-time employees throughout our global operations. To ensureemployee experience is “Belong. Believe. Be You.” By fostering this company culture, Belden welcomes a diverse workforce, we also revised all global job descriptions with inclusive language and essential requirements for diversity considerations. We rolled out unconscious bias training and trained more than 70% of our global employees, which significantly exceeded our target, in addition to holding diversity, equity, and inclusivity (DEI) trainings for our Senior Leadership Team. In 2022, in addition to our Denmark, Germany, and India locations that we recertifiedhas been recognized as a Great Place to Work®, we also earned accreditations for our Canada,Work in 17 countries – Belgium, China, Denmark, France, Germany, Hong Kong, Hungary, India, Mexico, the Netherlands, Singapore, Spain, Switzerland, Tunisia, the United Arab Emirates, the United Kingdom, and the United States locations.

Governance:

Belden is proudStates. We have prioritized Diversity, Equity, and Inclusion (DEI) by redesigning our DEI strategy, relaunching our DEI Council, and training 98% of employees on the topic of unconscious bias. We have also championed employees’ wellness, be that physical, social, financial, or emotional, with 65% of employees participating in our Be Well program. Additionally, we have upheld high standards of ethics throughout our supply chain by expecting our suppliers to be incorporating ESG goals intoattest to our executive compensation inSupplier Code of Conduct and undertaking audits with at-risk suppliers.

Stakeholder Engagement:

In 2022, ourthe United Nations Global Compact (UNGC), as well as their Caring for Climate pact. Additionally, Belden’s CEO has pledged to advance DEI initiatives by joining the CEO Action for Diversity and Inclusion initiativeInclusion. In early 2023, Belden joined the Responsible Business Alliance (RBA), which is dedicated to uphold our commitmentresponsible business practices throughout global supply chains.

| 2024 Proxy Statement | Page 9 | ||||||

|

|

•selecting and reviewing the independent registered public accounting firm who will audit the Company’s financial statements; |

|

•meeting with its financial management and independent registered public accounting firm to review the financial statements, quarterly earnings releases and financial data of the Company; |

|

•reviewing the selection of the internal auditors who provide internal audit services; |

|

•reviewing the scope, procedures and results of the Company’s financial audits, internal audit procedures, and internal controls assessments and procedures under Section 404 of the Sarbanes-Oxley Act of 2002 (“SOX”); |

|

•providing oversight responsibility for the process the Company uses in performing its periodic enterprise risk analysis; |

|

•providing oversight to the Company’s compliance and ethics programs and complaint reporting mechanisms; and |

|

Page 10 |

|  | ||||||

2023.

| 2024 Proxy Statement | Page 11 | ||||||

|

|

expertise, general management experience, and in-depth knowledge of the Company, and acts as an important liaison between management and the Company's non-employee directors.

| Page 12 | 2024 Proxy Statement |  | ||||||

| DIRECTOR COMPENSATION | |||

| |||

DIRECTOR COMPENSATION

| Description Cash Components | As of 12/31/ | Recipient(s) | ||||||||||||

Basic Retainer | 85,000 |

| All except Chand | |||||||||||

Audit Committee Chair | 20,000 |

| Calderon | |||||||||||

Other Committee Chair | 10,000 |

| Balk, Brink | |||||||||||

Audit Committee Service | 10,000 |

| Berglund, Brown, and Lee | |||||||||||

Compensation Committee Service | 5,000 |

| Aldrich and Klein | |||||||||||

Cybersecurity Committee Service | 5,000 |

| Berglund, Klein and | |||||||||||

Finance Committee Service | 5,000 |

| Balk and McCray | |||||||||||

Nominating and Corporate Governance Committee Service | 5,000 |

| Klein and McCray | |||||||||||

Board Chair | 50,000 |

| Aldrich | |||||||||||

Equity Components | ||||||||||||||

Restricted Stock Unit Grant | 150,000 |

| All except Chand | |||||||||||

Additional Grant for Board Chair | 50,000 |

| Aldrich | |||||||||||

(1) | Ms. Brink receives a Committee Chair payment for her service as chair of both the Cybersecurity Committee and the Nominating and Corporate Governance Committee |

| Director | Fees Earned or Paid in Cash(1) ($) | Stock Awards(2) ($) | Option Awards ($) | All Other Compensation(3) ($) | Total ($) | ||||||||||||

| David Aldrich | 140,000 | 199,999 | — | 936 | 340,935 | ||||||||||||

| Lance C. Balk | 100,000 | 150,021 | — | 45,976 | 295,997 | ||||||||||||

| Steven W. Berglund | 105,000 | 150,021 | — | 701 | 255,722 | ||||||||||||

| Diane D. Brink | 105,000 | 150,021 | — | 688 | 255,709 | ||||||||||||

| Judy L. Brown | 105,000 | 150,021 | — | 715 | 255,736 | ||||||||||||

| Nancy Calderon | 105,000 | 150,021 | — | 1180 | 256,201 | ||||||||||||

| Jonathan Klein | 100,000 | 150,021 | — | 701 | 250,722 | ||||||||||||

| YY Lee | 71,250 | 364,934 | — | 0 | 436,184 | ||||||||||||

| Gregory McCray | 95,000 | 150,021 | — | 698 | 245,719 | ||||||||||||

Director |

|

| Fees Earned or Paid in Cash(1) ($) |

|

|

| Stock Awards(2) ($) |

|

|

| Option Awards ($) |

|

|

| All Other Compensation(3) ($) |

|

|

| Total ($) |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David Aldrich |

|

|

| 140,000 |

|

|

|

| 195,012 |

|

|

|

| — |

|

|

|

| 905 |

|

|

|

| 335,917 |

|

Lance C. Balk |

|

|

| 100,000 |

|

|

|

| 144,990 |

|

|

|

| — |

|

|

|

| 26,096 |

|

|

|

| 271,086 |

|

Steven W. Berglund |

|

|

| 100,000 |

|

|

|

| 144,990 |

|

|

|

| — |

|

|

|

| 676 |

|

|

|

| 245,666 |

|

Diane D. Brink |

|

|

| 105,000 |

|

|

|

| 144,990 |

|

|

|

| — |

|

|

|

| 666 |

|

|

|

| 250,656 |

|

Judy L. Brown |

|

|

| 105,000 |

|

|

|

| 144,990 |

|

|

|

| — |

|

|

|

| 684 |

|

|

|

| 250,674 |

|

Nancy Calderon |

|

|

| 100,833 |

|

|

|

| 144,990 |

|

|

|

| — |

|

|

|

| 661 |

|

|

|

| 246,484 |

|

Brian Cressey |

|

|

| 39,583 |

|

|

|

| 144,990 |

|

|

|

| — |

|

|

|

| 776 |

|

|

|

| 185,349 |

|

Jonathan Klein |

|

|

| 100,000 |

|

|

|

| 144,990 |

|

|

|

| — |

|

|

|

| 676 |

|

|

|

| 245,666 |

|

George Minnich |

|

|

| 43,750 |

|

|

|

| 144,990 |

|

|

|

| — |

|

|

|

| 19,744 |

|

|

|

| 208,484 |

|

Gregory McCray |

|

|

| 87,083 |

|

|

|

| 287,765 |

|

|

|

| — |

|

|

|

| — |

|

|

|

| 374,848 |

|

| 2024 Proxy Statement | Page 13 | ||||||

|

|

| ITEM I – ELECTION OF DIRECTORS | ||

|

|

ITEM I – ELECTION OF DIRECTORS

The Company currently has ten directors – Mses. Brink, Brown, Calderon and Lee and Messrs. Aldrich, Balk, Berglund, Chand, Klein, and McCray. The term of each director will expire at this annual meeting and the Board proposes that each of Mses. Brink, Brown, Calderon and Lee and Messrs. Aldrich, Balk, Berglund, Chand, Klein, and McCray be reelected for a new term of one year and until their successors are duly elected and qualified. Each nominee has consented to serve if elected. If any of them becomes unavailable to serve as a director, the Board may designate a substitute nominee. In that case, the persons named as proxies will vote for the substitute nominee designated by the Board.

| THE BELDEN BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE NOMINATED SLATE OF DIRECTORS. | ||

Page 14 |

|  | ||||||

ITEM II – RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2023

| ITEM II – RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2023 | ||

2022

|

| 2022 |

|

| 2021 |

| |||||||||||||

| 2023 | |||||||||||||||||||

| Audit Fees | |||||||||||||||||||

| Audit Fees | |||||||||||||||||||

|

|

|

|

|

|

|

|

| |||||||||||

Audit Fees |

|

| $ | 3,014,000 |

|

|

| $ | 2,520,700 |

| |||||||||

Tax Fees |

|

| $ | 108,842 |

|

|

| $ | 64,076 |

| |||||||||

| Tax Fees | |||||||||||||||||||

| Tax Fees | |||||||||||||||||||

Total EY fees |

|

| $ | 3,122,842 |

|

|

| $ | 2,584,776 |

| |||||||||

| Total EY fees | |||||||||||||||||||

| Total EY fees | |||||||||||||||||||

| 2024 Proxy Statement | Page 15 | ||||||

| Audit Committee | |||||

Nancy Calderon (Chair) | |||||

Steven Berglund | |||||

Judy L. Brown | |||||

| YY Lee | |||||

| THE BELDEN BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE RATIFICATION OF ERNST & YOUNG AS THE COMPANY’S INDEPENDENT REGISTERED ACCOUNTING FIRM FOR | ||

| Page 16 | 2024 Proxy Statement |  | ||||||

|

|

2024.

2022

low, even in the face of an uncertain demand environment.

year, continuing to strengthen the alignment of Belden’s executives and its shareholders.

In February of 2023, certain newly promoted Belden managers, including the Company’s President and CEO, were granted additional 2022 PSUs, which are eligible for the Stretch Achievement Share Award enhancement, in order to put those managers in the position they would have been in had they been in their current roles in June of 2022, and to ensure that those managers are properly incentivized to deliver optimal long-term results for shareholders.

| LANCE BALK, CHAIR | DAVID ALDRICH | JONATHAN KLEIN | ||||||

| 2024 Proxy Statement | Page 17 | ||||||

| President and Chief Executive Officer | ||||

| Jeremy Parks | Senior Vice President, Finance, and Chief Financial Officer | ||||

| Brian Anderson | Senior Vice President, Legal – General Counsel and Corporate Secretary | ||||

| Brian Lieser | Executive Vice President, Industrial Automation Solutions | ||||

| Leah Tate |

| ||||

| Roel Vestjens | Former President and | ||||

|

|

•Adjusted Revenues of $2.512 billion, with adjusted EBITDA margin of 17.4%; |

|

•Adjusted EBITDA of $438.1 million; |

|

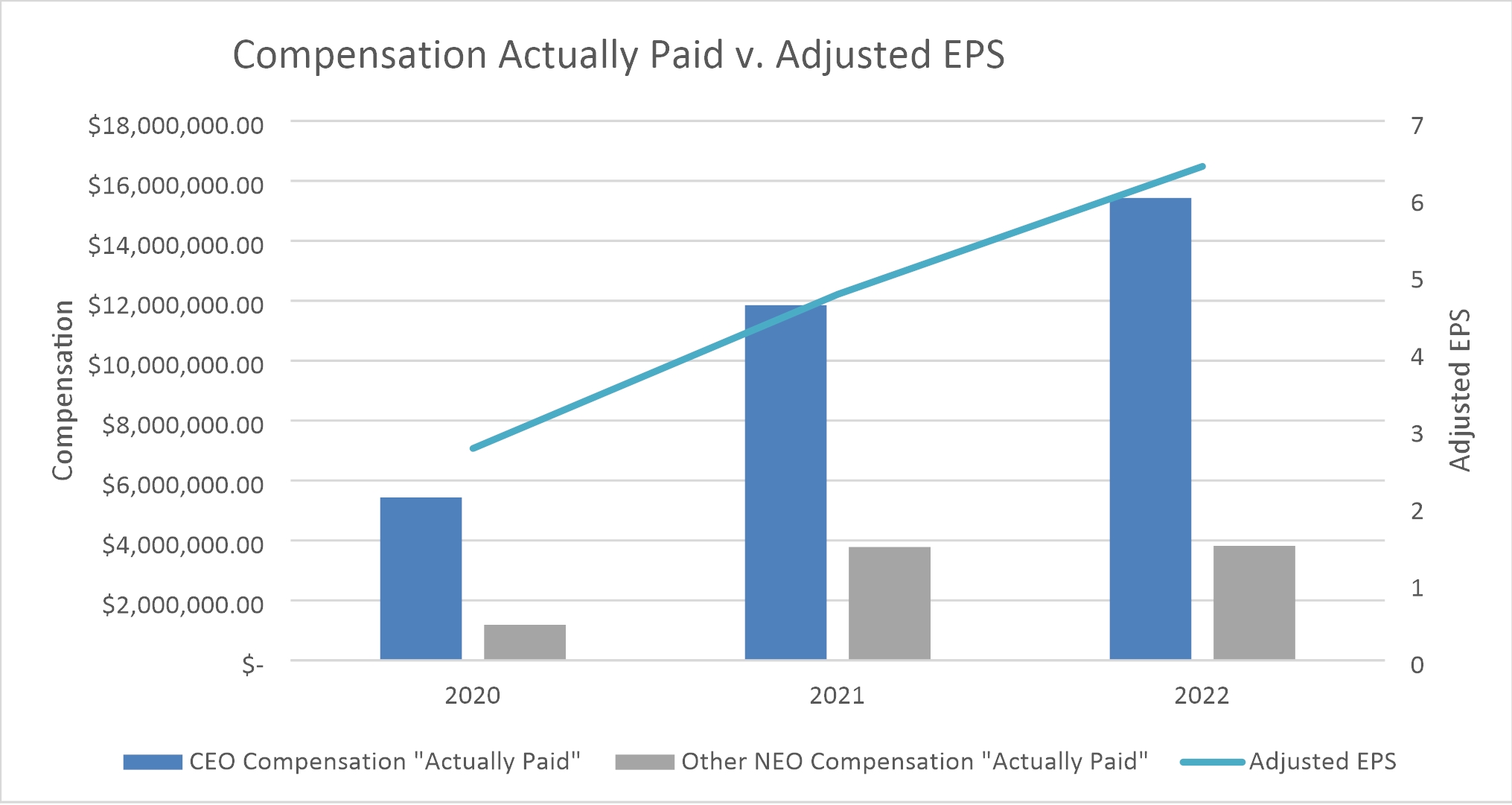

•Adjusted EPS of $6.83, a Company record; and •Free cash flow of $216.7 million. |

|

The Company’s 20222023 overall financial results and the individual performance of our NEOs are discussed under Annual Cash Incentive Plan Awards beginning on page 22.

|

|

•Performance stock unit awards granted under the long term incentive plan (“LTIP”) with the following features: |

|

•Performance measurement period of three years. |

|

•Two factor performance metrics. |

|

•Use of a relative measure (total stockholder return relative to the S&P 1500 Industrials Index). |

|

•No provision for any accrued dividend equivalents. |

|

•Rigorous goals for the realization of target ACIP and LTIP compensation set against objective measures. |

|

•Perquisite-light compensation structure with no change-in-control-related excise tax gross-ups. |

|

•Replacement of employment contracts with a uniform executive severance plan. |

|

•Double trigger change-in-control provisions for severance and for accelerated vesting in equity awards. |

|

•No history of option repricing or cash buyouts of underwater options. |

|

•Equity plans do not have evergreen share authorizations and do not allow for aggressive share recycling. |

|

•Robust director and officer ownership guidelines, including six times annual base salary for the Chief Executive Officer. |

|

| Page 18 | 2024 Proxy Statement |  | ||||||

|

|

IV. Compensation Objectives and Elements

| 2024 Proxy Statement |

| ||||||

|

|

B.Elements |

|

|

|

|

|

B. Elements

Below is an illustration of Belden’s compensation program. Individual compensation packages and the mix of base salary, annual cash incentive opportunity and long-term equity incentive compensation for each NEO vary depending upon the executive’s level of responsibilities, potential, performance and tenure with the Company. Each of the elements shown below is designed for a specific purpose, with the overall goal of achieving a high and sustainable level of Company and individual performance. The percentage of total compensation that is performance-based and therefore at risk generally increases as an officer’s level of responsibilities increases.

Performance Stock Units (“PSUs”)

Annual Cash Compensation

Long-Term Incentive Compensation

Stock Appreciation Rights (“SARs”)

Annual Cash Incentive Plan (“ACIP”) Opportunity

Base Salary

Restricted Stock Units (“RSUs”)

|

|

▪ |

| |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Objective: Supports retention and achievement of Company’s total stockholder return and free cash flow objectives; at risk if performance is below certain thresholds |

▪ | Represents 50% of target long-term incentive opportunity |

▪ |

|

▪ |

|

| Performance Stock Units (“PSUs”) | |||||||||||||||||

| |||||||||||||||||

| Stock Appreciation Rights (“SARs”) | |||||||||||||||||

| ▪Objective: Rewards for the Company’s stock price appreciation ▪Represents 25% of target long-term incentive opportunity ▪Vests equally over three years and has 10-year term ▪Has no value when market price is below the grant date price | ||||||||||||||||

| Long-Term Incentive Compensation | |||||||||||||||||

| Restricted Stock Units (“RSUs”) | |||||||||||||||||

| ▪Objective: Supports retention and aligning stockholder and executive incentives | ||||||||||||||||

▪ | Represents 25% of target long-term incentive opportunity |

▪ | Cliff vest three years after grant date | ||||||||||||||||

| Annual Cash Incentive Plan (“ACIP”) Opportunity | |||||||||||||||||

| ▪Objective: Rewards achievement of the Company’s performance targets and individual performance; zeros out if performance is below certain thresholds ▪Based on target ACIP amount, which is a percentage of base salary ▪If earned, paid annually following the computation and release of year-end financial results | ||||||||||||||||

| Annual Cash Compensation | |||||||||||||||||

| Base Salary | |||||||||||||||||

| ▪Objective: Compensates individuals based on job type and level within the Company ▪Eligible for merit-based increases in connection with annual performance review | ||||||||||||||||

Additionally, the Company provides competitive retirement and benefit programs to our NEOs on the same basis as other employees and limited perquisites as described under Compensation Policies and Other Considerations.

|

|

| Page 20 | 2024 Proxy Statement |

| ||||||

|

|

|

|

|

|

|

|

We believe that this philosophy has provided an appropriate balance to drive continuous improvement while retaining high performers through challenging times. More importantly, we believe the incentives we provide for achievement without rewarding under-performance contributes to our industry-leading employee engagement while aligning the interests of our managers closely with those of our customers and investors. A.O. Smith Corporation CommScope Holding Company, Inc. IDEX Corporation Curtiss-Wright Corporation Itron Inc. Viavi Solutions, Inc. Hexcel Corporation ITT Inc. categories: below market, market and above market. Company-wide, the ranking system, which assigns personal performance factors ranging from 0.5 to 1.5, is designed to take the form of a normal distribution. Current Name Annual Base Salary at December 31, 2022 Mr. Vestjens $ 1,000,000 Mr. Parks $ 543,900 Mr. Anderson $ 488,400 Mr. Chand $ 531,463 Mr. Mehrotra $ 420,000 (Dollar amounts in thousands) 2022 2021 2020 2019 2018 Adjusted Net Income from Continuing Operations $ 317,393 $ 216,942 $ 123,536 $ 209,974 $ 289,645 Tax effected ACIP Expense (assuming 30% rate) (a) $ 24,497 $ 26,427 $ 12,538 $ 8,562 $ 10,128 Adjusted Net Income Before ACIP Expense (b) $ 341,792 $ 243,369 $ 136,074 $ 218,536 $ 299,773 Reflected as a percentage (a divided by b) 7.17 % 10.86 % 9.21 % 3.92 % 3.38 % Form 8-K in which adjusted net income is reconciled to GAAP net income February 8, 2023 February 9, 2022 February 10, 2021 February 4, 2020 February 20, 2019 ACIP Award = Base Salary X Target Percentage X Financial Factor X Personal Performance Factor February 22, 2023; and Ms. Tate – 70%. Mr. Vestjens was not eligible to participate in the Annual Cash Incentive Plan in 2023 as a result of his resignation in February 2023. Weight Consistent with the terms of the annual cash incentive plan, the performance factors were adjusted to reflect certain unusual events that occurred during the year. The Compensation Committee and the Audit Committee meet jointly to analyze and approve the adjustments recommended by management. The Committees agree that it was appropriate to adjust the financial performance targets for these matters to properly capture our operating results and to eliminate the potential for managers delaying strategic decisions beneficial to the Company in the long term (e.g., restructuring) because of the impact of those decisions on short-term financial metrics or Page 24 Financial Factor 1.05. 0.85 – 1.15 1.16 – 1.50 70% – 120% 100% – 190% Target. Page 26 NEO SARs(1) PSUs RSUs Mr. Vestjens 39,793 33,184 16,592 Mr. Parks 8,657 7,220 3,610 Mr. Anderson 5,830 4,862 2,431 Mr. Chand 11,572 9,650 4,825 Mr. Mehrotra(2) 4,417 3,683 4,342 (1) Factor Threshold Target Maximum Actual Relative TSR 25th Percentile 50th Percentile 75th Percentile 79th Percentile Consolidated Free Cash Flow 208,000,000 346,000,000 484,000,000 536,000,000 Page 27 Shares Awarded upon Conversion of 2020 PSUs NEO PSUs Shares Mr. Vestjens 7,857 15,714 Mr. Parks — — Mr. Anderson 4,622 9,244 Mr. Chand 6,748 13,496 Mr. Mehrotra — — Page 28 , the Company adopted its Policy for the Recovery of Erroneously Awarded Compensation on November 30, 2023. Page 29 Average summary Average Value of Initial fixed $100 compensation compensation investment based on: Summary Summary table total actually paid Peer Compensation Compensation to non-PEO to non-PEO group table total table total Compensation Compensation named named Total total Adjusted for for actually paid actually paid executive executive shareholder shareholder Net Earnings PEO (Vestjens) PEO (Stroup) to NEO (Vestjens) to NEO (Stroup) officers officers return return Income Per Share Year ($) ($) ($) ($) ($) ($) ($) ($) ($) ($) (a) (b) (b) (c) (c) (d) (e) (f) (g) (h) (i) 2022 6,936,527 — 15,432,523 2,101,935 3,822,182 132 128 254,822,000 6.41 2021 6,831,323 11,850,022 2,870,217 3,781,899 121 136 64,317,000 4.75 2020 2,648,191 8,385,634 1,531,547 3,901,946 1,985,910 1,188,948 77 112 (55,058,000 ) 2.75 Item and Value Added (Deducted) 2022 2021 2020 For Mr. Vestjens - change in actuarial present value of pension benefits $0 $0 $0 + service cost of pension benefits $0 $0 $0 + prior service cost of pension benefits $0 $0 $0 - SCT “Stock Awards” column value $3,026,712 $3,077,646 $1,133,356 - SCT “Option Awards” column value $874,650 $895,635 $197,989 + Covered year-end fair value of outstanding equity awards granted in Covered Year $11,481,543 $7,506,516 $968,550 +/- change in fair value (from prior year-end to Covered Year-end) of equity awards outstanding at Covered Year-end that were granted in prior years $943,557 $930,622 $(663,721) + vesting date fair value of equity awards granted and vested in Covered Year $0 $0 $0 +/- change in fair value (from prior year-end to vest date in Covered Year) of prior-year equity awards vested in Covered Year $(35,512) $546,513 ($95,009) - prior year-end fair value of prior-year equity awards forfeited in Covered Year $0 $0 $0 + includable dividends/earnings paid or accrued on equity awards during Covered Year $7,770 $8,329 $4,881 For Mr. Stroup - change in actuarial present value of pension benefits - - - - $448,473 + service cost of pension benefits - - $178,758 + prior service cost of pension benefits - - $0 - SCT “Stock Awards” column value - - - - $6,835,918 - SCT “Option Awards” column value - - $0 + Covered year-end fair value of outstanding equity awards granted in Covered Year - - $4,312,695 +/- change in fair value (from prior year-end to Covered Year-end) of equity awards outstanding at Covered Year-end that were granted in prior years - - - - $(1,384,045) + vesting date fair value of equity awards granted and vested in Covered Year - - $0 +/- change in fair value (from prior year-end to vest date in Covered Year) of prior-year equity awards vested in Covered Year - - $(322,304) - prior year-end fair value of prior-year equity awards forfeited in Covered Year - - $0 + includable dividends/earnings paid or accrued on equity awards during Covered Year - - $15,599 For Non-PEO Named Executive Officers (Average): - change in actuarial present value of pension benefits $0 $6,839 $78,767 + service cost of pension benefits $10,348 $18,682 $22,350 + prior service cost of pension benefits $0 $0 $0 - SCT “Stock Awards” column value $624,214 $1,314,184 $826,883 - SCT “Option Awards” column value $167,466 $138,351 $153,156 + year-end fair value (from prior year-end to Covered year-end) of equity awards granted in Covered Year $2,243,314 $2,135,122 $693,974 +/- change in fair value of outstanding equity awards granted in prior years $311,697 $396,261 $(441,802) + vesting date fair value of equity awards granted and vested in Covered Year $0 $0 $0 +/- change in fair value (from prior year-end to vest date in Covered Year) of prior-year equity awards vested in Covered Year $(57,911) $38,593 $(17,327) - prior year-end fair value of prior-year equity awards forfeited in Covered Year $0 $221,889 $0 + includable dividends/earnings paid or accrued on equity awards during Covered Year $4,479 $4,286 $4,649 Performance Measure 2022 Consolidated Net Income $ 285,400,000 2022 Consolidated EBITDA $ 443,600,000 2022 Consolidated Revenue $ 2,606,000,000 Relative Total Shareholder Return (S&P Industrial 1500 Index) (2020-2022) 79% Consolidated Free Cash Flow (2020-2022) $ 536,000,000 2022 Adjusted Earnings Per Share $ 6.41 Neither Belden’s overall employee population nor its employee compensation arrangements changed materially in 2023 in a way that Belden believes would result in a significant change to its pay ratio disclosure. As a result, the same median employee identified by Belden in 2023 serves as the median employee for the purposes of the 2024 pay ratio disclosure. 2023. the principal executive officers. 2024 Proxy Statement SUMMARY COMPENSATION TABLE Change in Pension Non- Value and Equity Nonqualified Incentive Deferred Plan Compen- All Other Stock Option Compen- sation Compensa- Salary(1) Bonus(2) Awards(3) Awards(4) sation(5) Earnings(6) tion(7) Total Name and Principal Year ($) ($) ($) ($) ($) ($) ($) ($) Position (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) Roel Vestjens 2022 946,875 — 3,026,712 874,650 1,950,000 — 138,290 6,936,527 President and 2021 778,125 — 3,077,646 895,635 1,996,313 — 83,604 6,831,323 Chief Executive Officer 2020 424,594 — 1,133,356 197,989 858,000 — 34,252 2,648,191 Jeremy Parks 2022 530,425 — 668,247 190,281 685,314 — 182,143 2,256,410 Senior Vice 2021 459,375 271,259 1,197,960 200,624 735,735 — 119,343 2,984,296 President, Finance, and Chief Financial Officer Brian Anderson 2022 476,300 — 443,463 128,143 615,384 — 49,574 1,712,864 Senior Vice President, Legal 2021 440,000 — 510,708 148,629 720,720 34,195 40,062 1,894,314 General Counsel and Corporate Secretary 2020 305,008 50,000 713,275 116,471 258,342 124,468 27,815 1,595,379 Ashish Chand 2022 523,942 — 880,177 254,353 877,113 — 396,868 2,932,453 Executive Vice President, 2021 494,285 — 3,723,987 240,138 865,219 — 280,777 5,604,406 Industrial Automation 2020 395,738 — 784,956 170,042 287,930 — 802,029 2,440,695 Anshu Mehrotra 2022 415,000 — 504,967 97,086 425,954 — 63,004 1,506,011 Executive Vice President, 2021 385,608 400,000 1,138,266 102,362 655,200 — 20,076 2,701,512 Broadband & 5G Mr. Vestjens Mr. Parks Mr. Anderson Mr. Chand Mr. Mehrotra 2022 9,496,763 2,085,676 1,391,430 2,761,684 1,223,050 2021 5,249,799 1,684,526 871,155 5,999,239 1,386,500 2020 1,839,291 — 1,139,927 1,306,644 — Life Company’s Insurance Contributions and Long In Its Defined Term Tax Restricted LTI Contribution Disability Preparation Stock Cash Housing Total Plan Benefits Costs Dividends Airfare Bonus Allowance Roel Vestjens 138,290 118,718 4,863 7,500 7,209 — — — Jeremy Parks 182,143 43,252 2,733 — 748 67,526 — 67,884 Brian Anderson 49,574 40,141 4,327 4,800 306 — — — Ashish Chand 396,868 52,728 5,418 — 1,159 — 87,563 250,000 Anshu Mehrotra 63,004 34,434 5,052 — 1,209 3,184 — 19,125 Page 37 All Other Stock Awards: All Other Grant Number Option Exercise Date Fair of Awards: or Base Value of Estimated Future Payouts Under Estimated Future Payouts Shares Number of Price of Stock Non-Equity Incentive Plan Under Equity Incentive Plan of Securities Option and Awards(1) Awards(2) Stock or Underlying Awards(5) Option Grant Award Threshold Target Maximum Threshold Target Maximum Units Options(4) ($ per Awards Name Date Type ($) ($) ($) (#) (#) (#) (#) (3) (#) Share) ($) (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (l) Roel Vestjens ACIP 650,000 1,300,000 2,600,000 2/22/2022 RSU 16,592 892,484 2/22/2022 PSU 12,444 33,184 132,736 2,134,229 2/22/2022 SAR 39,793 53.79 874,650 Jeremy Parks ACIP 190,365 380,730 1,142,190 2/22/2022 RSU 3,610 194,182 2/22/2022 PSU 2,708 7,220 28,880 474,065 2/22/2022 SAR 8,657 53.79 190,281 Brian Anderson ACIP 170,940 341,880 1,025,640 2/22/2022 RSU 2,431 130,763 2/22/2022 PSU 1,823 4,862 19,448 312,699 2/22/20022 SAR 5,830 53.79 128,143 Ashish Chand ACIP 199,299 398,597 1,195,792 2/22/2022 RSU 4,825 259,537 2/22/2022 PSU �� 3,619 9,650 38,600 620,640 2/22/2022 SAR 11,572 53.79 254,353 Anshu Mehrotra ACIP 150,500 301,000 903,000 2/22/2022 RSU 1,842 99,081 8/22/2022 RSU 2,500 168,950 2/22/2022 PSU 1,382 3,684 14,736 236,936 2/22/2022 SAR 4,417 53.79 97,086 2024 Proxy Statement OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END Option Awards Stock Awards Name Number of Number of Equity Option Option Number Market Equity Equity (a) Securities Securities Incentive Plan Exercise Expiration of Shares Value of Incentive Plan Incentive Plan Underlying Underlying Awards: Price(4) Date or Units Shares or Awards: Awards: (a) Unexercised Unexercised Number of ($) (f) of Stock Units of Number of Market Options(1) Options(2)(3) Securities (e) That Stock Unearned or Payout (#) (#) Underlying Have Not That Shares, Value of Exercisable Unexercisable Unexercised Vested Have Not Units or Unearned (b) (c) Unearned (#) Vested Other Shares, Units Options (g) ($) Rights That or Other (#) (h) Have Not Rights That (d) Vested(5) Have Not # Vested(6) (i) ($) (j) Roel Vestjens 6,697 — 72.570 3/4/2024 — — 3,929 282,495 8,356 — 89.230 2/25/2025 2,406 172,991 12,337 — 74.910 2/22/2027 20,073 1,443,249 13,606 — 72.730 2/28/2028 16,592 1,192,965 14,847 — 61.790 2/28/2029 7,857 564,918 7,217 3,608 51.140 2/11/2030 40,147 2,886,569 16,313 32,624 45.110 2/16/2031 33,184 2,385,930 — 39,793 53.790 2/22/2032 Jeremy Parks 3,654 7,308 — 45.110 2/16/2031 — — 4,496 323,262 — 8,657 53.790 2/22/2032 7,477 537,596 3,610 259,559 8,993 646,597 7,220 519,118 Brian Anderson 434 — 72.570 3/4/2024 — — 11,039 793,704 5,535 — 89.230 2/25/2025 2,311 166,161 6,769 — 52.890 2/24/2026 765 55,004 6,854 — 74.910 2/22/2027 3,011 216,491 7,257 — 72.730 2/28/2028 3,331 239,499 10,448 — 61.790 2/28/2029 2,431 174,789 4,246 2,122 51.140 2/11/2030 4,622 332,322 2,707 5,414 45.110 2/16/2031 6,662 478,998 — 5,830 53.790 2/22/2032 4,862 349,578 Ashish Chand 537 — — 72.570 3/4/2024 — — 3,374 242,591 1,103 — 89.230 2/25/2025 964 69,312 738 — 52.890 2/24/2026 5,382 386,966 1,477 — 74.910 2/22/2027 22,428 1,612,573 2,312 — 72.730 2/28/2028 4,825 346,918 9,580 — 61.790 2/28/2029 6,748 485,181 6,198 3,099 51.140 2/11/2030 10,764 773,932 4,347 8,747 45.110 2/16/2031 22,428 1,612,573 — 11,572 53.790 2/22/2032 9,650 693,835 Anshu Mehrotra 1,865 3,728 — 45.110 2/16/2031 — — 12,093 869,487 — 4,417 53.790 2/22/2032 2,294 164,939 1,842 132,440 2,500 179,750 4,588 329,877 3,683 264,808 2024 Proxy Statement For 2025.His 8,009 unexercisable SARs expiring on March 7, 2033 will vest as follows: 2,670 on March 7, 2024; 2,670 on March 7, 2025; and 2,669 on March 7, 2026. 2024 Proxy Statement Option Awards Stock Awards Number of Value Number of Value Shares Acquired Realized on Shares Acquired Realized on on Exercise(1) (2) Exercise on Vesting Vesting Name (#) ($) (#) ($) (a) (b) (c) (d) (e) Roel Vestjens 1,865 134,093 25,793 1,469,670 Jeremy Parks — — 3,739 207,739 Brian Anderson 727 52,271 4,663 259,558 Ashish Chand — — 2,253 120,134 Anshu Mehrotra — — 6,046 380,656 2024 Proxy Statement Date Number of SARS Market Price Exercise Price Pre-tax proceeds Resulting shares Value at 12/31/22 08/04/2022 5,392 $67.145 $50.01 $92,392 759 $54,572 08/04/2022 9,435 $67.145 $52.89 $134,496 1,106 $79,521 Date Number of SARS Market Price Exercise Price Pre-tax proceeds Resulting shares Value at 12/31/22 02/25/2022 2,290 $55.615 $39.83 $36,148 421 $30,270 11/08/2022 1,241 $77.210 $50.01 $33,755 306 $22,001 PENSION BENEFITS Present Value of Number of Years Accumulated Payments During Credited Service Benefit(2) Last Fiscal Year Name Plan Name(1) (#) ($) ($) (a) (b) (c) (d) (e) Roel Vestjens Pension Plan — — — Excess Plan — — Jeremy Parks Pension Plan 12.4 205,092 — Excess Plan — — Brian Anderson Pension Plan 14.6 262,863 — Excess Plan 169,121 — Ashish Chand Pension Plan — — — Excess Plan — — Anshu Mehrotra Pension Plan — — — Excess Plan — — Executive Registrant Aggregate Aggregate Aggregate Contributions Contributions Earnings Withdrawals/ Balance in Last FY in Last FY in Last FY Distributions at Last Name ($) ($) ($) ($) FYE ($) (a) (b) (c) (d) (e) (f) Roel Vestjens 156,091 118,718 9,770 — 677,366 Jeremy Parks 68,131 43,252 1,174 — 112,557 Brian Anderson 152,222 40,141 5,982 — 414,280 Ashish Chand 68,103 52,728 1,701 — 141,935 Anshu Mehrotra 184,800 34,434 3,062 — 245,067 •if the executive is the Company’s Chief Executive Officer, severance payments equal to the sum of the officer’s current base salary plus his target bonus, multiplied by 1.5, payable in equal semi-monthly installments over an eighteen-month period; •any unpaid bonus earned with respect to the portion of the current fiscal year completed as of the date of termination based on the actual performance under the applicable annual cash incentive plan, payable when awards are generally paid for senior executives for such year; and •willful and continued failure to perform his duties following appropriate opportunities to cure the deficiencies; •conviction or plea of nolo contendere of a felony or engagement in a dishonest act, misappropriation of funds, embezzlement, criminal conduct or common law fraud; •material violation of the Company’s Code of Conduct; and •any unpaid annual cash incentive award earned with respect to any fiscal year ending on or preceding the date of termination, payable when awards are paid generally to senior executives for such year; •A pro-rated annual cash incentive for the fiscal year in which the termination occurs, the amount of which shall be based on target performance and a fraction, the numerator of which is the number of days elapsed during the performance year through the date of termination and the denominator of which is 365; •a lump sum severance payment payable at the time provided by Section 4.02(e) in the aggregate amount equal to the product of (A) the sum of (1) the Participant’s highest base salary during the time between the change of control and the date that is two years following the change of control plus (2) the executive’s annual target cash incentive award for the year in which the termination occurs multiplied by (B) two (2); •a lump sum payment equal to the full monthly premium (i.e., the executive’s and the Company’s) for coverage under the Company group health care plan (including group dental and vision coverage) based on the executive’s coverage elections in effect immediate prior to the termination multiplied by 24; •unvested PSUs convert to RSUs at a 1.00 conversion ratio at the time of the “change in control;” and •A pro-rated annual cash incentive award for the fiscal year in which such termination occurs, the amount of which shall be based on actual performance under the applicable annual cash incentive plan and a fraction, the numerator of which is the number of days elapsed during the performance year through the date of termination and the denominator of which is 365, which pro-rated cash incentive award shall be paid when awards are paid generally to senior executives for such year; •Any unvested equity awards will vest immediately; •The pro rata portion of PSUs related to the amount of time the employee was employed during the measuring period will convert to shares of Company common stock when awards are converted generally for such year; 2024 Proxy Statement Page 45 Accelerated Vesting 2022 Non- of Equity Value Equity Stock Welfare Excise Tax Aggregate Incentive Plan Restricted Options/ Benefits Gross-up Severance Compensation Stock Units SARs Continuation Payment Total Name ($) ($) ($) ($) ($) ($) ($) Roel Vestjens Termination not for cause not in connection with a change in control 3,450,000 1,950,000 — — 30,782 — 5,430,782 Termination not for cause by the Company or for good reason by the officer after a change in control 4,600,000 1,950,000 8,944,025 1,669,550 41,042 — 17,204,617 Death/Disability — 1,950,000 8,944,025 1,669,550 — 12,563,575 Retirement — — — — — — — Jeremy Parks Termination not for cause not in connection with a change in control 924,630 685,314 — — 21,680 — 1,631,624 Termination not for cause by the Company or for good reason by the officer after a change in control 1,849,260 685,314 2,291,644 352,560 43,360 — 5,222,138 Death/Disability — 685,314 2,291,644 352,560 — — 3,329,518 Retirement — — — — — — Brian Anderson Termination not for cause not in connection with a change in control 830,280 615,384 — — 23,275 — 1,468,939 Termination not for cause by the Company or for good reason by the officer after a change in control 1,660,560 615,384 2,874,701 294,675 46,550 — 5,491,870 Death/Disability — 615,384 2,874,701 294,675 — — 3,784,760 Retirement — — — — — — Ashish Chand Termination not for cause not in connection with a change in control 930,060 877,113 — — 24,367 — 1,831,540 Termination not for cause by the Company or for good reason by the officer after a change in control 1,860,121 877,113 6,199,375 455,492 48,734 — 9,440,835 Death/Disability — 877,113 6,199,375 455,492 — — 7,531,980 Retirement — — — — — — — Anshu Mehrotra Termination not for cause not in connection with a change in control 735,000 425,954 — — 23,926 — 1,184,880 Termination not for cause by the Company or for good reason by the officer after a change in control 1,470,000 425,954 1,947,673 179,865 47,852 — 4,071,344 Death/Disability — 425,954 1,947,673 179,865 — — 2,553,492 Retirement — — — — — — — The Dodd-Frank Act requires that we include in this proxy statement a non-binding stockholder vote on our executive compensation as described in this proxy statement (commonly referred to as “Say-on-Pay”). THE BELDEN BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE COMPANY’S EXECUTIVE COMPENSATION. Page OWNERSHIP INFORMATION A B C Number of Securities Remaining Available for Number of Future Issuance Under Securities to be Weighted Equity Compensation Issued Upon Average Exercise Plans (Excluding Exercise of Price of Securities Plan Category Outstanding Options Outstanding Options Reflected in Column A) Equity Compensation Plans Approved by Stockholders(1) 957,937(2) $ 64.13 3,003,869.79 (3) Equity Compensation Plans Not Approved by Stockholders — — — Total 957,937 $ 64.13 3,003,869.79 1934. Name Number of Shares Acquirable Within Percent of Class Beneficially Owned(1)(2)(3)(4)(5) 60 Days(6) Outstanding(7) David Aldrich 55,641 — * Brian Anderson 41,848 51,023 * Lance Balk(8) 114,646 — * Steven W. Berglund 26,463 — * Diane D. Brink 18,783 — * Judy L. Brown 27,723 — * Nancy Calderon 6,210 — * Ashish Chand 72,842 37,650 * Jonathan Klein 11,553 — * YY Lee(9) — — * Gregory McCray 5,155 — * Anshu Mehrotra 15,090 5,202 * Jeremy Parks (10) 26,730 10,194 * Roel Vestjens 348 8,356 * All directors and executive officers as a group (17 persons) 462,145 139,872 * BENEFICIAL OWNERSHIP TABLE OF STOCKHOLDERS OWNING MORE THAN FIVE PERCENT BlackRock, Inc. The Vanguard Group 2024 Proxy Statement OTHER MATTERS 2024; and Q: What are Belden’s voting recommendations? Q: What shares owned by me can be voted? Election of Directors Majority of votes cast for Present for quorum purposes; not counted in determining whether a director has received more votes Not present for quorum purposes; brokers do not have discretion to vote non-votes in favor of directors No requirement; not binding on company The Board of Directors will consider the number of abstentions in its analysis of the results of the advisory vote Count as present for quorum purposes; brokers have discretion to vote non-votes in favor of ratification No requirement; not binding on company The Board of Directors will consider the number of abstentions in its analysis of the results of the advisory vote Not present for quorum purposes; brokers do not have discretion to vote non-votes in favor of compensation matters *The Company’s bylaws, as amended, provide that, in an uncontested election, a director must receive more votes “for” than votes “against” to be elected to the Board. An incumbent director that fails to receive such a majority shall tender his or her resignation, which will be considered by the Board’s Nominating and Corporate Governance Committee. Q: D.D. Compensation DesignRole of Compensation ConsultantFollowing an analysis based on rules promulgated by the NYSE, the Compensation Committee retained Meridian Compensation Partners LLC (“Meridian”) as its independent compensation consultant during 2022.2023. Meridian reported directly to the Committee. The Committee generally relies on the independent compensation consultant to provide it with comparison group benchmarking data and information as to market practices and trends, and to provide advice on key Committee decisions.In 2022,2023, Meridian provided advice to the Compensation Committee and management in connection with the composition of peer companies we use for benchmarking purposes and the design of our annual cash incentive and long-term incentive programs.Benchmarking and Survey DataIn determining total compensation levels for our NEOs, the Compensation Committee reviews market trends in executive compensation and a competitive analysis prepared by the independent compensation consultant, which compares our executive compensation to both the companies in the comparator group described below and to broader market survey data. The Compensation Committee also considers other available market survey data on executive compensation philosophy, strategy and design. The Company’s compensation philosophy is to target base salaries at the 50th percentile of the competitive market. Individual executives may have base salaries above or below the target based on their individual performances, internal equity and experience. As discussed above, at-risk incentive compensation components have the potential to reward our executives at levels above industry medians, but only when the Company is outperforming the industry.The Compensation Committee chose our comparator group from companies in the primary industry segments in which the Company operates and competes for talent.The comparator group companies for 20222023 were as follows:Roper Technologies, Inc.Acuity Brands, Inc. Amphenol Corporation Zurn Elkay Water Solutions Carlisle Companies Incorporated Hubbell Incorporated Regal Rexnord Corporation Zurn Water SolutionsCarlisle Companies IncorporatedHubbell IncorporatedRogers Corp.The Compensation Committee considers the comparator group competitive pay analysis and survey data as relevant, but non-determinative data points in making its pay decisions. The approach to pay decisions is not formulaic and the Committee, based on advice from the compensation consultant, exercises judgment in making them.Each year, the Compensation Committee reviews the performance evaluations and pay recommendations for the named executive officers and the other senior executives. The Compensation Committee, with input from the Board, meets in executive session without the CEO present to review the CEO’s performance and set his compensation. In its most recent review in February 2023,2024, the Compensation Committee concluded that the total direct compensation of executive officers, with respect to compensation levels, as well as structure, are consistent with our compensation design and objectives.V. 20222023 Compensation AnalysisA.Base Salary AdjustmentsSalaries of executive officers are ordinarily reviewed annually and at the time of a promotion or other change in responsibilities. Increases in salary are based on a review of the individual’s performance against objective performance measures, the competitive market, the individual’s experience and internal equity. For executives who earn a composite individual performance score of 0.91 or more, base salaries may be adjusted using a merit salary increase matrix, discussed below. An executive who scores less than 0.91 and fails to improve his or her performance may be subject to disciplinary action, including dismissal.

2024 Proxy Statement Page 21 The executive is scored on our merit salary increase matrix that is annually reviewed by the Committee and, if appropriate, revised to reflect the competitive market, based on the salary survey data noted above. The executive’s salary is classified based on three 2023 Proxy Statement

2023 Proxy StatementPage 2120222023 Merit Increase Guidelines for Named Executive OfficersPersonal Performance Factor Current Salary

Salary as a % of

Midpoint0.50–0.90 0.91–1.10 1.11–1.50 Current SalaryAbove Market 106% and Above Midpoint0%-4.5% 0.50–0.900.91–1.101.11–1.50Market 95%-105% 0% 0%-5.5% 4%-10.0% AboveBelow Market Below 95% Above 105%4.5%-9.0% 0%0%-3%2%-6%Market95%-105%0%0%-4%4%-9%Below MarketBelow 95%0%3%-6%6%-11%The timing and amount of any salary adjustment will be based on the executive’s annual overall performance ranking and whether the executive falls “below,” “at” or “above” market as compared to the median of the applicable market data noted above.For example, an executive with an overall ranking of “1.25” who is “above market” will receive a lower salary increase than an executive with a ranking of “1.25” who is “below market”.The named executive officers’ salaries as of December 31, 20222023 are provided in the following table.Name Annual Base Salary atDecember 31, 2023Dr. Chand $900,000 Mr. Parks $587,412 Mr. Anderson $527,472 Mr. Lieser $440,000 Ms. Tate $448,200 B.Annual Cash Incentive Plan AwardsExecutive officers participate in our annual cash incentive plan. Overall, we had 1,6722,047 employees participate in the plan’s 20222023 performance offering. Under the plan, participants earn cash awards based on the achievement of Company and individual performance goals. For 2022,2023, the amount paid under the plan to all participants was approximately $34.996$20.513 million or approximately 7.14%4.74% of adjusted net income before ACIP expense. This compares to approximately 7.1%, 10.9%, 9.2%, 3.9%, and 3.4%,3.9% in 2022, 2021, 2020, 2019, and 2018,2019, respectively, as shown below:(Dollar amountsin thousands)2023 2022 2021 2020 2019 Adjusted Net Income from Continuing Operations $ 288,792 $ 317,393 $ 216,942 $ 123,536 $ 209,974 Tax effected ACIP Expense (assuming 30% rate) (a) $ 14,359 $ 24,497 $ 26,427 $ 12,538 $ 8,562 Adjusted Net Income Before ACIP Expense (b) $ 303,151 $ 341,792 $ 243,369 $ 136,074 $ 218,536 Reflected as a percentage (a divided by b) 4.74 % 7.17 % 10.86 % 9.21 % 3.92 % Form 8-K in which adjusted net income is reconciled to GAAP net income February 8, 2024 February 8, 2023 February 9, 2022 February 10, 2021 February 4, 2020 A participant’s award (other than Mr. Vestjens)Dr. Chand’s) is computed using the following formula:Page 22 2023 Proxy StatementIn 2012, based on the fact that the Chief Executive Officer’s personal performance factor (“PPF”) had consistently been equal to or greater than 1.0, the Compensation Committee removed the component from the calculation of the Chief Executive Officer’s ACIP award. The Committee desired to avoid any perception that the PPF was simply serving as a

2023 Proxy StatementIn 2012, based on the fact that the Chief Executive Officer’s personal performance factor (“PPF”) had consistently been equal to or greater than 1.0, the Compensation Committee removed the component from the calculation of the Chief Executive Officer’s ACIP award. The Committee desired to avoid any perception that the PPF was simply serving as aPage 22 2024 Proxy Statement  second multiplier to the CEO’s award. Given his direct reporting relationship to the Board, the Committee is comfortable that

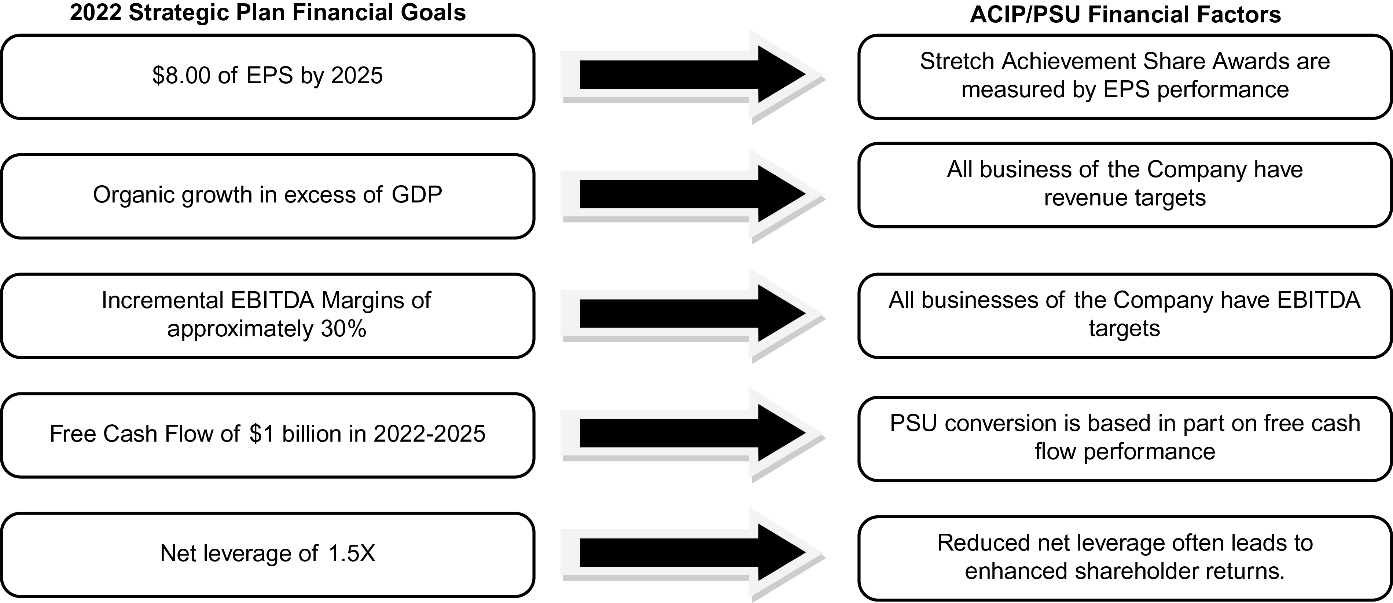

second multiplier to the CEO’s award. Given his direct reporting relationship to the Board, the Committee is comfortable that Mr. VestjensDr. Chand is fully accountable without the need of the additional lever to adjust his ACIP award downward or upward.Target PercentagesFor 2022,2023, each NEO’s ACIP Target Percentages were as follows: Mr. Vestjens–130%Dr. Chand 75%, Mr. Chand–75%,increasing to 120% upon his appointment as President and CEO on February 22, 2023; Messrs. Anderson and Parks – 70%,; Mr. Mehrotra–70%Lieser – 50%, increasing to 75% upon his appointment as Executive Vice President, Broadband & 5GIndustrial Automation Solutions on September 1, 2022.Financial FactorsPerformance targets for calculating the Financial Factors were based on net income, from continuing operations, revenue, EBITDA, operating working capital turns and inventory turns.EBITDA. In addition, as discussed further below, the performance stock units (“PSUs”) had performance targets based on relative total stockholder return and free cash flow. In an effort to reinforce and enhance Belden’s “One Belden” philosophy, every ACIP eligible Belden associate’s financial factor includes, at least in part, the consolidated Belden financial factor that measures the Company’s performance as a whole. As illustrated below, in order to ensure that we are rewarding performance that drives stockholder value, ACIP financial factors and long-term equity incentive plan performance targets flow from and support the strategic financial goals we communicate to our investors.

2023 Strategic Plan Financial Goals ACIP/PSU Financial Factors  Performance Factor Determination and AdjustmentsThe performance factors we use that make up the Financial Factor support our short- and long-range business objectives and strategy. We have selected multiple factors because we believe no one metric is sufficient to capture the performance we are seeking to achieve and any one metric in isolation may not promote appropriate management performance. Management and the Board believe that income from continuing operations and EBITDA are the financial metrics most clearly aligned with the enhancement of stockholder value. Therefore, they are weighted heavily in our consolidated and platform targets. Additionally, revenue growth has been highlighted by our stockholders as a key component of value creation. Consistent with our Lean manufacturing philosophy, continuous improvement in inventory and working capital turnover remains a high corporate priority.In setting performance goals, we consider our annual and long-range business plans and factors such as our past variance to targeted performance, economic and industry conditions, and our industry performance. We set challenging, realistic goals that will motivate performance within the top quartile of our comparator group. We recognize that the metrics may need to change over time to reflect new priorities and, accordingly, review these performance metrics at the beginning of each performance period.In

Performance Factor Determination and AdjustmentsThe performance factors we use that make up the Financial Factor support our short- and long-range business objectives and strategy. We have selected multiple factors because we believe no one metric is sufficient to capture the performance we are seeking to achieve and any one metric in isolation may not promote appropriate management performance. Management and the Board believe that income from continuing operations and EBITDA are the financial metrics most clearly aligned with the enhancement of stockholder value. Therefore, they are weighted heavily in our consolidated and platform targets. Additionally, revenue growth has been highlighted by our stockholders as a key component of value creation. Consistent with our Lean manufacturing philosophy, continuous improvement in inventory and working capital turnover remains a high corporate priority.In setting performance goals, we consider our annual and long-range business plans and factors such as our past variance to targeted performance, economic and industry conditions, and our industry performance. We set challenging, realistic goals that will motivate performance within the top quartile of our comparator group. We recognize that the metrics may need to change over time to reflect new priorities and, accordingly, review these performance metrics at the beginning of each performance period.In 2022,2023, threshold, target and maximum levels for the performance factors that make up the Financial Factors were set to challenge management to achieve upper quartile performance, including with respect to consolidated revenue, consolidated net income, and consolidated EBITDA.Officers with company-wide responsibilities (Messrs. Vestjens,(Dr. Chand, Messrs. Parks and Anderson)Anderson, and Ms. Tate) were measured using consolidated performance. Mr.Dr. Chand, during his tenure as Executive Vice President of Industrial Automation Solutions, was compensated based on the performance of the Industrial Automation segment. Mr. Mehrotra,Lieser, who had company-widehas responsibilities during his tenure as Senior Vice President, Sales and Marketing and now has specific responsibilities related tofocused

2024 Proxy Statement Page 23 on the Company’s Broadband & 5G business as the Executive Vice President of 2023 Proxy Statement